Insights:

All Aboard The Earnings Carousel: The Importance of Timing

All Aboard The Earnings Carousel: The Importance of Timing

The importance of reporting cycle timing is frequently overlooked by companies of all sizes, particularly when it comes to the earnings call. An understanding of the discrete reporting rhythm of your sector and peer group is key to not only capturing an optimal window, but also for gathering impactful peer intelligence, capturing relevant questions from your covering analysts, and ultimately, the publication of a high quality transcript that will live on in perpetuity.

Get to Know Your Space

Correctly timing your earnings call can minimize event overlap with peers, crucial in preventing dilution of covering analysts and your potential investor audience. To host your call at the same time as a peer or similar sector company is to risk splitting your audience, or worse, having your analyst’s junior asking a question in their place. Unless you’re the market leader, with a market cap and industry relevance that towers over peers, there is no rush to host a call without consideration of the wider calendar. Don’t position yourself to be the underdog, whose calendar invite is bumped for the larger peer. Instead, confirm when your peers are hosting their events as early as you can, and work around the date and time. Following in the footsteps of your sector leaders can provide a wealth of intelligence on quarterly themes and the key questions on analysts’ minds. Listen in where you can, or trawl their transcripts for useful soundbites and phrases. Associate yourself, were appropriate, with their narratives and thematic messaging from the quarter. Similarly, take the opportunity to listen in to the calls of your customers to get ahead of readthrough messaging that may come up so you can best address issues proactively before they become an issue on your own transcript.

To Lead or to Learn?

So when in the cycle should you look to host your call? In our experience, smaller companies should always play it slow, wait for the bigger players to get out there and take any industry headwinds on the chin. Thursdays are the typical log jam day during earnings, particularly the ‘third Thursday’ of the season. Companies tend to cluster their calls together, with analysts bouncing from call to follow up to call while they churn out their previews and post-call reports. Conversely, Mondays and Fridays remain the quieter days of the week, with Mondays often lost to management meetings and playing email catch up, and Fridays drifting into weekends and vacations (especially during the summer cycles!).

Play to the Calendar

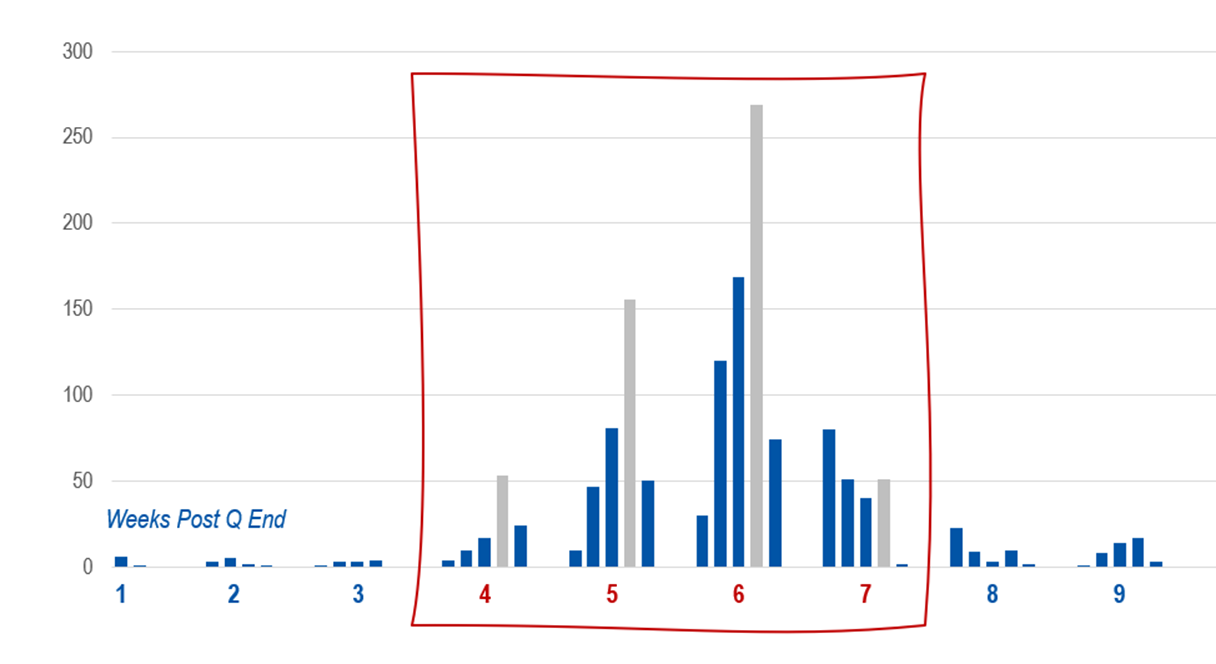

At Rose and Company, we regularly conduct analysis on specific sector cadence and rhythm to get a snapshot of how companies should best position themselves within their sector. The below charts reflect the typical distribution of the Russell 2000 constituent earnings calls during a given reporting cycle. The prevalence of ‘week three’ is clear, but what is interesting to note is the distribution of call timing across sectors. As can be seen from the second set of charts, the financial sector tends to report earlier, with the majority of calls in week one of the cycle as they release their overarching market information, providing a trickle-down of performance data for the wider economy. The healthcare sector, one of the largest sectors by number of companies, tends to then report on the later end of the cycle, with weeks three and four seeing the most activity. Whatever your market cap size or sector, be sure to be aware of the space you occupy. Lever your identity as a market leader to get out in front with new industry narratives, or use your flexibility as a small company to ride the messaging coat tails of your sector leaders.

The Bottom Line

Correctly timing an earnings call can minimize event / audience overlap with peers and also provide a company the opportunity to either gain knowledge from peer and customer earnings reports or establish a thought leadership position in their sector. Whatever your market cap size or sector, remember that earnings season is inherently a time to deliver your story and key messages to a captive audience. So use the opportunity as a market leader to get out in front with new industry narratives, or use the flexibility of being a small company to draft behind sector leaders and customers.