Insights:

Corporate Access: The Rules of Engagement Have Changed

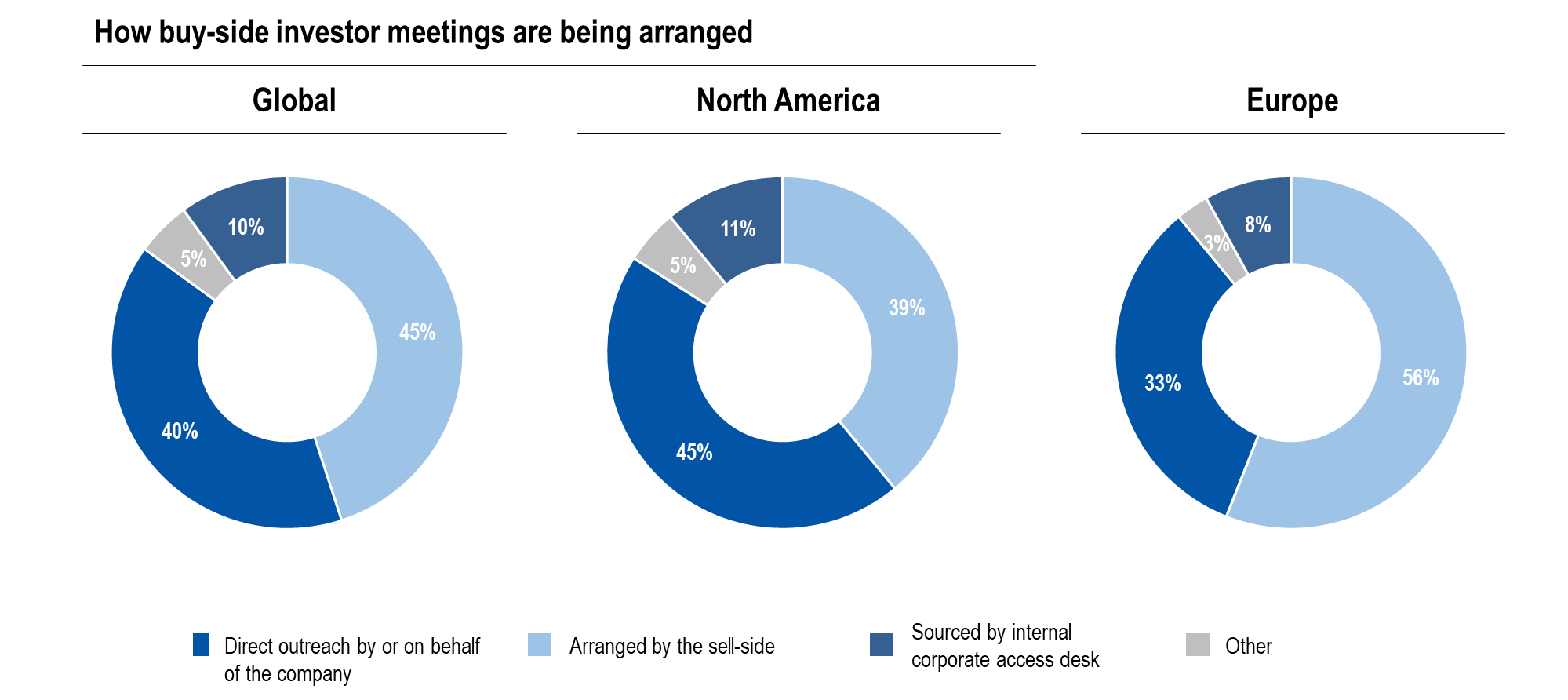

Many institutions have become less reliant on the sell-side for corporate access, according to a recent survey published by Investor Relations Magazine. This is primarily due to budget compression on the buy-side that has made portfolio managers think twice about accepting meetings offered by the sell-side. The MiFID II regulations were a catalyst for this change in behavior, but it has really been years in the making. According to the survey, less than 50% of all meetings with investors are being arranged by the sell-side these days. In North America, in particular, direct access by companies or on behalf of companies in the case of Rose & Company clients, has resulted in more meetings than meetings offered by the sell-side.

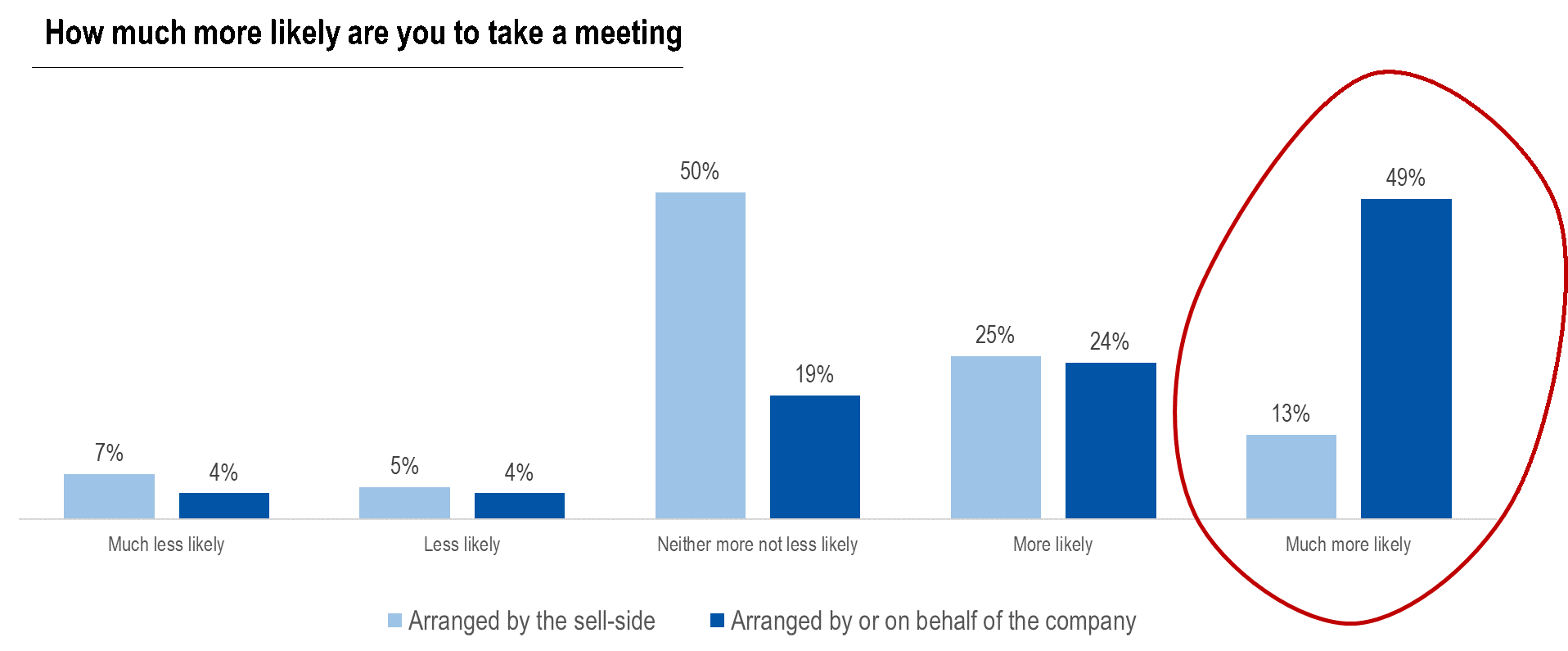

According to the same survey, institutional investors want companies to contact them directly. Nearly half of respondents were ‘much more likely’ to take a meeting arranged by or on behalf of the company themselves, a stark contrast with the 13% of respondents who said they were ‘much more likely’ to take meetings arranged by the sell-side. It’s pretty clear to us that the rules of engagement have changed, and a new approach needs to be taken to access the broadest possible universe of institutional investors.