The conference calendar hints at the need for a new approach to investor outreach

Investment banks’ shifting commitment to investor events provides a leading indicator for investor relations officers

Almost a year has passed since the MiFID II directive came into force. This year has been described as transitional as both investment banks and institutional investors digest and respond to the new regulation. The anecdotes began to pile up as the year progressed. Notably, we hear that conference attendance is down ~20-30 percent, and various prominent institutional investors have told us that their research and corporate access budgets have been set anywhere from 20 percent to 60 percent below 2017 levels.

Investment banks are naturally more reluctant to talk about how the new regulations might impact the level of service they provide to their institutional investor and corporate clients. It’s difficult to predict how things will ultimately unfold, but we foresee more transition taking place in 2019 and beyond.

Investment banks have provided some clues

Every year around this time, we begin to develop investor marketing programs for the upcoming year on behalf of our corporate clients. We always pay close attention to the conference calendar when thinking through marketing plans – both to look for opportunities for our clients to participate and to mark off dates to hold back on marketing (tip: do not try to market to generalist investors the week of the Consumer Electronics Show and the JP Morgan Healthcare Conference – it’s just a bad idea).

This year, we got sidetracked by curiosity and decided to see if we could measure changing behavior on the part of the banks by comparing conferences announced thus far for 2019 with the 2018 conferences announced around the same time in 2017. It’s an imperfect exercise as it relies heavily on the accuracy and completeness of the data (special thanks to the Seminar Schedule, Virtua Research and FactSet), but our findings are noteworthy enough to publish. We share our observations below along with some informed guidance for IROs and the C-Suite.

The premise: Conferences require significant commitments from the sponsoring bank

The decision on whether to proceed with a conference needs to be made well in advance. If you have ever tried to find a suitable venue in New York that can accommodate 500+ people on short notice you know what we mean. The conference calendar is also very competitive, and the bank that sends out their save the date early has first mover advantage in the competition for investor commissions. An investor conference can cost anywhere from $200k to $2mn, and the forward conference calendar may therefore be a good leading indicator for how banks will allocate resources in the future. Having provided a bit of background, let’s look at what the data shows and try to draw some conclusions.

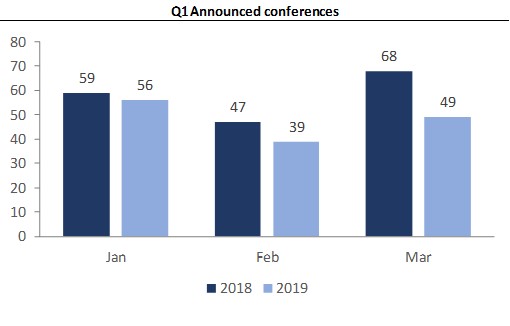

Announced conferences are decidedly down heading into 2019. Thirty less conferences are being marketed for the first quarter of 2019 compared with the same period last year. That’s a 17 percent decline. We would caution you not to look past the first quarter of 2019 until the new year begins as a smaller portion of the conferences that occur in the back half of the year get marketed this far in advance.

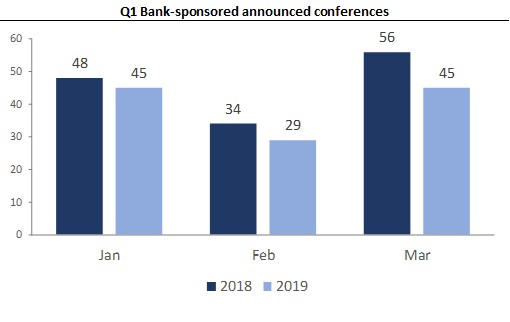

The majority of the disappeared conferences are bank-sponsored. There are 19 less bank-sponsored conferences scheduled for Q1 2019 compared to Q1 2018. The second quarter looks to be a bit more consistent at this stage, but it’s too early to form a view. Check in with us for updates as we will be following this closely going forward.

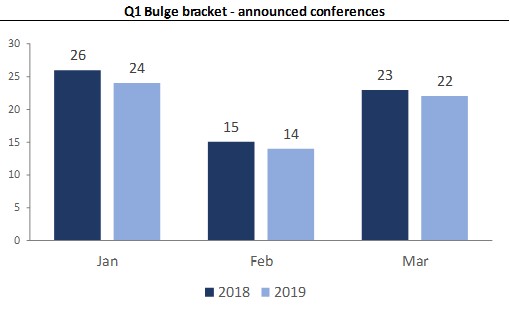

Digging deeper, it’s a case of the “haves” and “have nots.” Various institutional investors have told us that they have cut their broker lists – in part to create economies of scale with those brokers that provide access to a broader swath of products. Yes, we are talking about the bulge bracket banks, who have in turn stated that they will maintain their “flagship” conferences despite observing attendance declines in the 20-30% range.

The number of announced bulge bracket conferences for the first quarter is roughly flat compared to the prior year. We note that these commitments have likely been set in stone for quite some time. The third quarter looks a bit more tenuous and bears watching closely along with the fourth quarter.

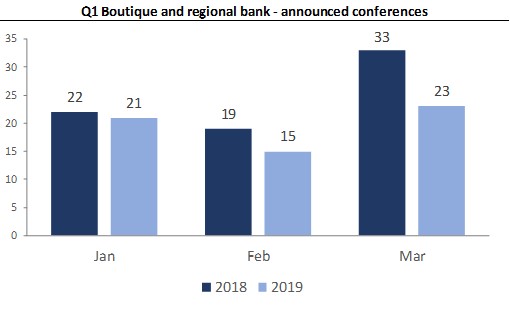

We see a pronounced drop in conferences sponsored by boutiques and regional firms. Several market commentators have forecasted that smaller firms would suffer the most in a post-MiFID II world, and we may be starting to see the impact felt in the conference calendar.

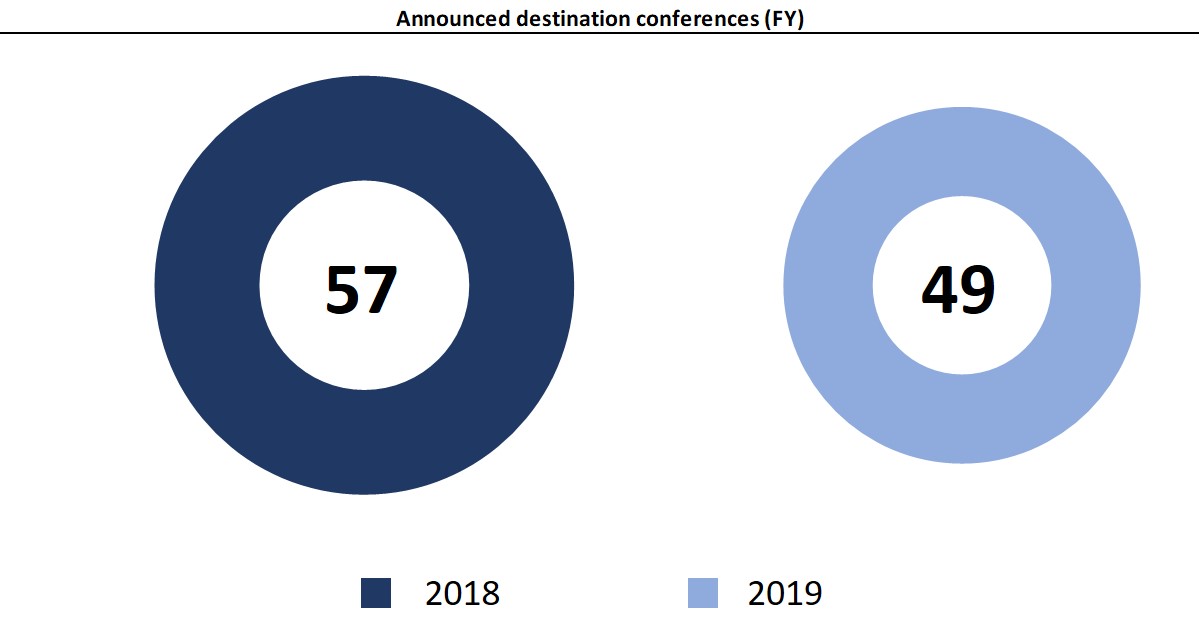

Also of note, destination conferences may be dying a slow death. These are often planned up to 18 months in advance and are only derailed due to a shock to the system (like MiFID II). Announced conferences in locales with climates more hospitable than ours in NYC are down 14 percent compared to the prior year.

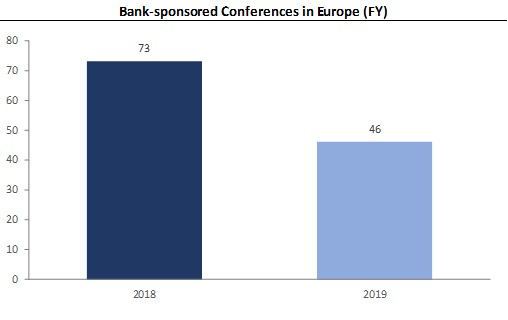

One change observed is almost definitely a result of MiFID and too significant to be explained away. There is a (shockingly) large decline in announced conferences occurring in Europe, the region explicitly impacted by MiFID. Announced conferences in Europe are down by 27, or 37 percent, compared to the prior year. This figure will surely put fear into any European IRO.

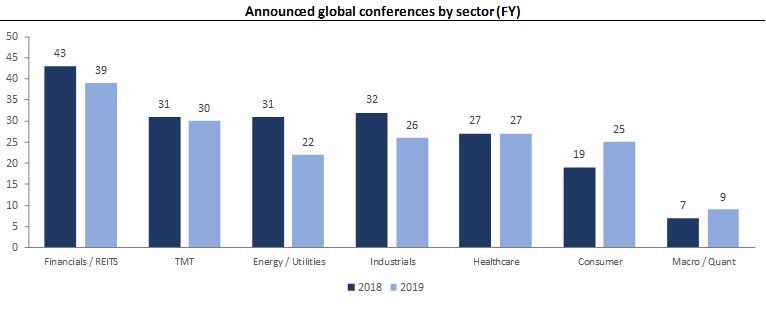

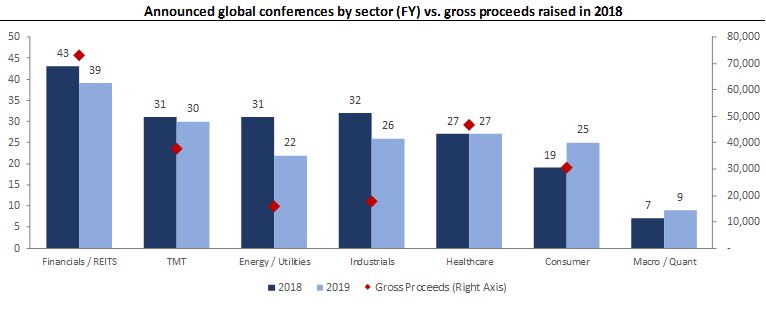

Finally, it’s worth noting that not all sectors have seen the same level of decline. The Energy and broader Industrials sectors look to bear the brunt of the declines in 2019 with announced conferences showing declines of 29 percent and 19 percent, respectively. Tech, Healthcare and Consumer are enjoying the greatest support. This is due to relative levels of investment banking activity in various sectors.

After all, revenue opportunities drive investment banks’ budgets. Regardless of whether commissions continue to slide, a banking fee will always trump a regular-way trade, and a bank isn’t very likely to generate banking fees without showing commitment to a sector. If there are less fees to be earned in a particular sector, internal budgets will shift. Here’s the same chart showing gross proceeds from capital markets transactions by sector (right hand axis) through mid-November of 2018. The relationship is pretty clear – the less banking opportunities exist in a sector, the less resources will be allocated to that sector. This is particularly true for cyclical industries and more pronounced following MiFID II.

So what does this all mean for the corporate? Several months after May Day in 1975, when brokerage commissions went from fixed to negotiated, Philip A. Loomis, Jr., who was the commissioner of the SEC at the time, stated that the consequences were ‘still not entirely clear’. The May Day regulations ultimately gave rise to the full-service brokerage model and the proliferation of the equity research and corporate access products. Forty-three years later, regulation continues to impact the economic relationship between investment banks and institutional investors. The lasting impact on corporates is still not entirely clear, but short-term indicators look ominous. The research and corporate access landscape has certainly begun to change, and 2019 is likely be another transitional year where trends should be closely watched.