The Continuing Impact of Regulations on the Broker Model

The Continuing Impact of Regulations on the Broker Model

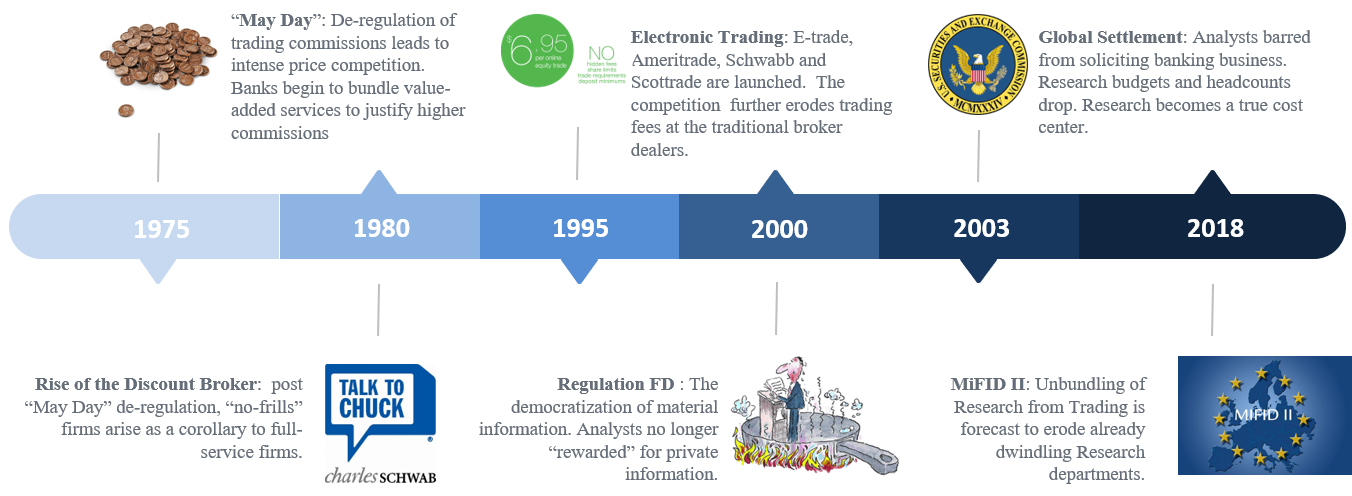

From the deregulation of trading commissions in the 1970s to the Global Research Settlement in 2003, securities regulations have consistently produced significant shifts in the way the buy-side, the sell-side, and issuers interact. Research departments, in particular, have been subject to numerous changes, which have altered the relationship between issuers and investment banks.

With the implementation of MIFID II in January 2018, a new paradigm shift is underway. Investment banks may no longer give away services that are deemed to have value like research and corporate access, and investment managers may no longer accept them without budgeting for them in advance. Further, any payments made for services of value must be explicitly segregated from trading commissions, if paid for with client funds, or paid directly from investment managers using management fees. In many cases, investment managers have elected to pay for such services directly from their management fees.

The impact of MIFID II on sell-side and buy-side business models has been discussed extensively in the financial media. The potential impact on issuers has thus far been largely overlooked.

What We Know

While the full impact of MiFID II remains unknown, it is becoming increasingly clear that issuers will need to devote greater efforts to identifying and directly interacting with an audience of the “right" investors.